Smart City, Smart People, Smart Data

Smart City, Smart People, Smart Data

Creating a smart city is based on concepts of innovation, technology, sustainability and accessibility ensuring economic progress as well as a higher quality of life. This is opening an infinite number of opportunities to become more efficient in both public and private management. It means that both the public sector, as well as the private (all types of business) sector have to be prepared to express their ambitions collaboratively about what they want to achieve in the future.

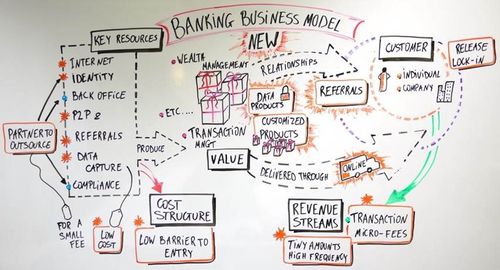

Democratisation of technology has meant that people are much more demanding, informed, über-connected and multi-channel. With the advent of new technologies in particular Internet of things, new business models are emerging to build solutions that increase or improve the citizens’ quality of life. from optimising public transport routes to using smart garbage bins to track litter habits.

Whilst the deployment of smart cities involve several innovative technologies to facilitate sustainable urban spaces, the concept is still vague and open. The ‘smart’ capabilities need to be operational and measurable. In order to evaluate how ‘smart’ is a smart city, robust data management and analysis is required.

This entails very close collaboration between both public and private sectors to share and analyse the vast amount of data being generated by new technologies. There are a billion places to gather data, and more tools are coming to market to help collect as much of it as possible.

The ability to share vital information in real time would enable businesses operating both in the private and public sector to develop powerful hardware systems and software solutions; that not only support automation but provide the ‘smart’ capabilities of a city and its infrastructure. Today, there’s an assortment of technologies being used to handle various characteristics, such as high volume, data location, and a variety of data source types. The collection of crucial data from any kind of source, such as the own city’s sensors, participatory sensing (for instance, sensors integrated in citizens’ smartphones), would enable the compilation of information about people and vehicle traffic, parking, environmental values, waste generated, energy consumption and healthcare etc. for the smart functioning of the city’s basic services.

It’s easier said than done one is tempted to say. Whatever the hype, whether artificial intelligence, machine learning or automation, it must start with data. Data is vital for smart cities technology.

First and foremost sound and mature data management practices need to be in place. Technology alone is not sufficient to build a smart city. Competent human intelligence is also part of the equation to complete this: Employees need to be comfortable analyzing and making decisions with data. Not only should the data analytics platform be robust, the team’s responsible for it must have a good mix of skills. The tecchies and fuzzies of this world will drive the vision of the Smart City not the traditional analysts.

“Finding solutions to our greatest problems requires an understanding of human context as well as of code; it requires both ethics and data, both deep thinking people and Deep Learning AI, both human and machine; it requires us to question implicit biases in our algorithms and inquire deeply into not just how we build, but why we build and what we seek to improve.” * (Scot Harley )

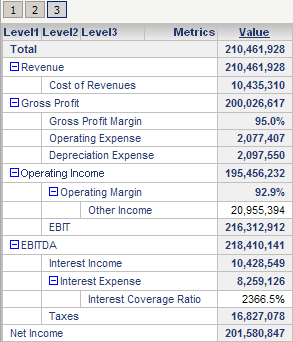

The essential question in the continuously growing amount of data volumes is how to make practical use of these volumes and without analytics, interpretation and algorithms it just isn’t possible. Advanced analytics has emerged as a critical component of modern analytics architecture, with companies turning to statistics, predictive algorithms, and machine learning to maximize the value of very large data sets. Without having to examine every dimension and variation in the data manually, people are automatically guided to relevant insights and alerted to data points that are worth exploring. The use of AI-driven smart data for customer analysis, fraud detection, market analysis, and compliance is becoming a reality to uncover insights hidden in data.

Investing in a strong modern analytics platform leverages the partnership between Business and IT . When business users are given tools to analyze data on their own, they are free to answer questions on the fly, knowing they can trust the data itself. This leads to accurate, agile reports and dashboards and one single version of truth. And IT, free from dashboard and change requests, can finally prioritize the data itself: safeguarding data governance and security, ensuring data accuracy, and establishing the most efficient pipelines for collecting, processing, and storing data.

Adapting to a scenario that is extremely technologically, economically and socially dynamic is the lynchpin of development and helps to drive smart systems geared towards improving integration and interaction of the smart citizen.

When data is approached intelligently to generate insights into how the tech systems are performing it is only then that efficiencies and savings could be measured across all strategic elements of Smart Cities -enterprise competitiveness, mobility, urbanism, energy, water, waste recycling, security, culture and healthcare.