4 ways visual analytics can be additive to improve financial analysis

What if financial professionals had a faster way to complete all of their reporting and scale ad-hoc question and answer cycles? What if the finance department could improve the communication of insights to the entire enterprise—even within existing tech stacks, and large disparate databases?

Modern financial departments are adding self-service, visual analytics to their existing processes to deliver richer and more actionable insights to the business faster.

4 ways visual analytics can be additive to improve financial analysis and save significant time across many use cases and finance teams:

- Unify and use all of your data

- Scale and repeat analysis faster

- Interactive, ad-hoc analytics reveal data outliers

- Improve organisational communication if insights

1.Unify and use all of your data

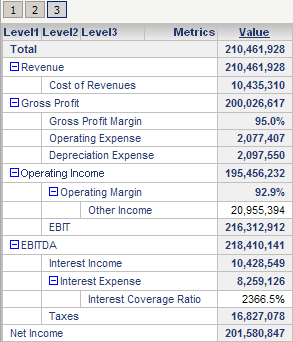

Regardless of the size of your organization, there’s financial data everywhere—and a lot of it. Whether you want to analyze live enterprise resource planning (ERP) data living in a warehouse, or transactional data living in the cloud, or still dump HR and CRM data into different spreadsheets, you can combine any and all of it within a single, visual analytics platform, and blend it on a common field to see more accurate, holistic views of your data.

Once you have your data connected and unified with a visual analytics platform, not only will you be able to select specific data sets on-the-fly, and choose which metrics to work with, you’ll spend way more time doing deeper analysis in a visual setting.

2.Scale and repeat analysis faster

Whether you’ve been filling your spreadsheets to the breaking point, working with smaller data sets, or running sophisticated macros and calculations in spreadsheets, you’re often left waiting and miserable. You just need to iterate your existing analysis more quickly— you need to be able to ask and answer your data questions without having to start over every time. Once you’ve

unified your data, you’re ready to take your analysis to the next level with visual analytics.

3.Interactive, ad-hoc analytics reveal data outliers

Visual analytics are not chart wizards—they’re interactive, can connect to live data sources, and offer an ever-changing analysis of what’s happening now, not last week or last month. Visual analytics can take static reports and turn them into automated and interactive dashboards that anyone can access for the most accurate insights at any time. Everyone in the finance department will spend less time dealing with broken formulas, human error, and more time interacting with data in a dynamic way to explore and reveal critical insights coming from data outliers.

4.Improve organisational communication of insights

With visual and interactive dashboards, collaboration is built in as an integral step in the organization’s cycle of analytics. There are no additional configurations or add-ons required to share or collaborate with data, and because users can ask and answer their own questions directly in the dashboard, there are fewer redundant emails and requests to run more numbers. Finance users can simply publish and share dashboards online, to a server, or directly with the people with whom they want to collaborate, and they can immediately see how often reports are being viewed and used. And with live data connections, reports aren’t instantly out of date.

Source:Tableau Software